Save more for school with SavvyFi

Welcome! You’re on your way to using your wellness stipend to save for your dreams for higher education.

Welcome! You’re on your way to using your wellness stipend to save for your dreams for higher education.

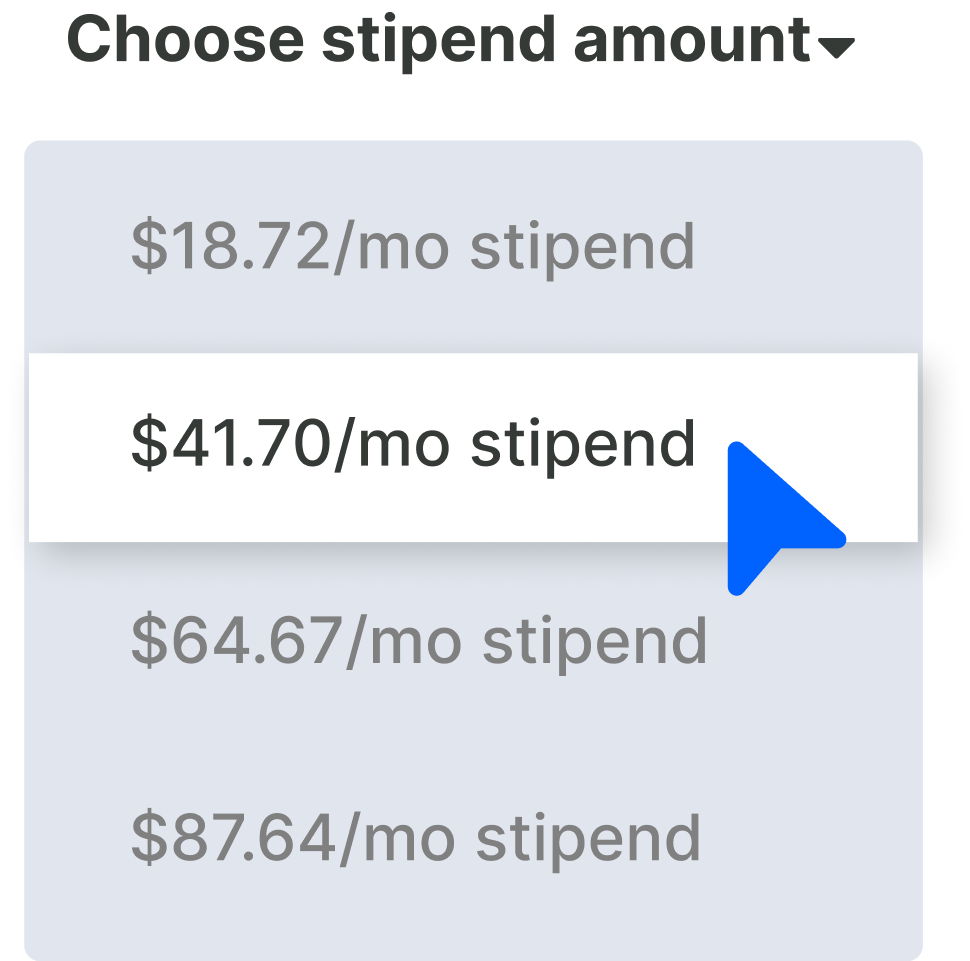

Choose a monthly stipend amount on Forma.

Open a SavvyFi account with your work email and enter the Forma promo code.

Create a tax-advantaged 529 savings account.

SavvyFi sends the contribution to your 529 account each month.

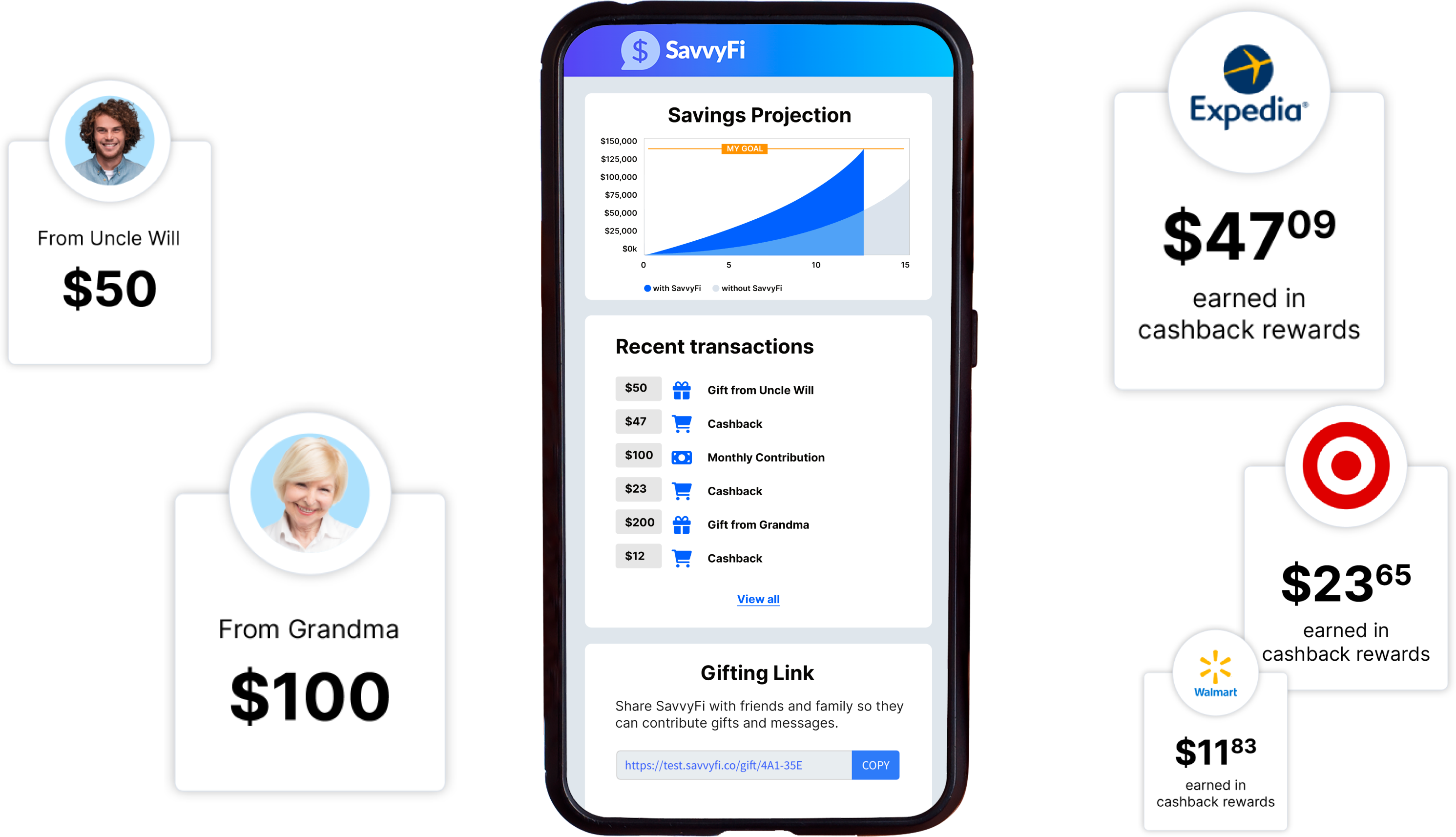

SavvyFi is a digital web application that allows you to save for a loved one’s education and/or pay down your current student loans more quickly with cashback rewards on everyday shopping, gifts from friends and family, and for select workplaces, employer contributions.

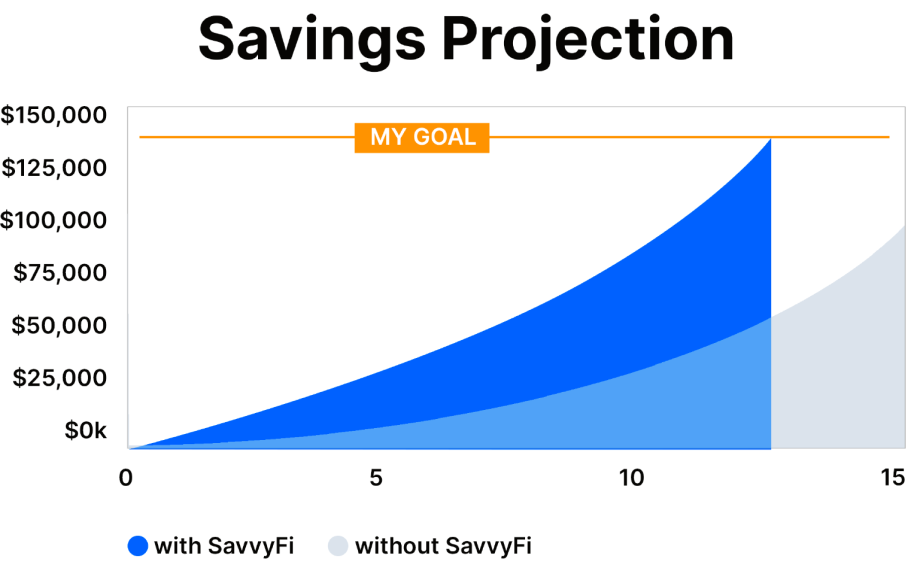

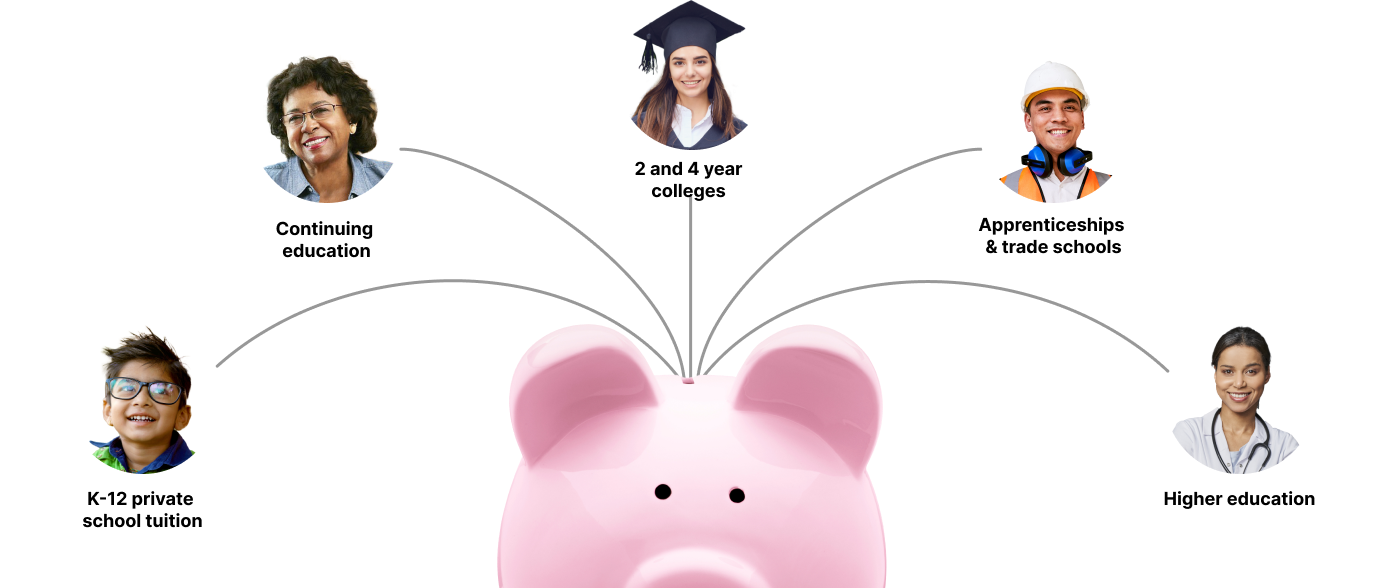

A 529 account is an investment account that allows your savings to grow tax-free if the funds are used for qualified expenses at eligible higher education institutions. This includes expenses such as tuition, room and board, and books. Tax-free growth means you get a boost on your investment earnings that wouldn't be available otherwise.Eligible institutions include four-year universities, community colleges, trade schools, and private K-12 schools. Qualified expenses typically cover most costs associated with attending school. Learn more at: https://savvyfi.co/what-is-a-529/

Your 529 account beneficiary is the person you are saving for. It can be a child, grandchild, friend, yourself, or anybody else.

Choose how much of your available wellness stipend funds on Forma you would like to allocate to your SavvyFi 529 accounts. Once you select this amount, SavvyFi will send that amount on the first of the month to your 529 account.

If you leave your company, your 529 accounts will continue to exist and belong to you. You have the option to continue using the SavvyFi gifting, cashback, and planning features by assuming the monthly cost.

If your beneficiary does not attend college, there are many options. You can transfer the 529 account to another family member, use the funds for your own education, roll the 529 plan over to a Roth IRA, or cash out the account with a 10% penalty and increased taxable income on only any earnings that have accrued.

my529, is the official 529 plan established and sponsored by the State of Utah. But, you don’t have to live in Utah to own or be the beneficiary of a my529 account. Funds can be used at any eligible educational institution in the U.S. or abroad that participates in a federal student financial aid program. For 14 years running, my529 has been named one of the country’s top 529 educational savings plans by Morningstar, a leading industry analyst.

In your profile, you are given a personalized link to share with others. This allows you to easily receive gifts and messages from friends and family, which are sent directly to your 529 savings account. Gifts can be funded with bank accounts, credit cards, and PayPal.

Savvy Financial, Inc. (“SavvyFi”) is a web-based investment adviser. Our investment advisory services are made available to U.S. residents only. This website shall not be considered a solicitation or offering for any service or product to any person in any jurisdiction where such solicitation or offer would be unlawful. Nothing in this website should be construed as investment, legal, tax, regulatory or accounting advice. Prospective investors should consult with their own legal, regulatory, tax, business, investment, financial and accounting advisers. While distributions to cover K–12 tuition are tax-free on the federal level, state tax treatment will vary, and you should check with your tax professional for details. All investments involve risk, including the possible loss of money you invest, and past performance does not guarantee future performance.