How to Launch

(in under 24 hours)

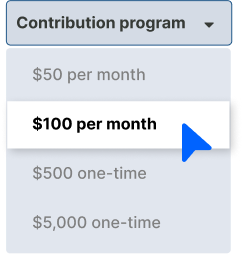

Provide SavvyFi with your employer contribution program design

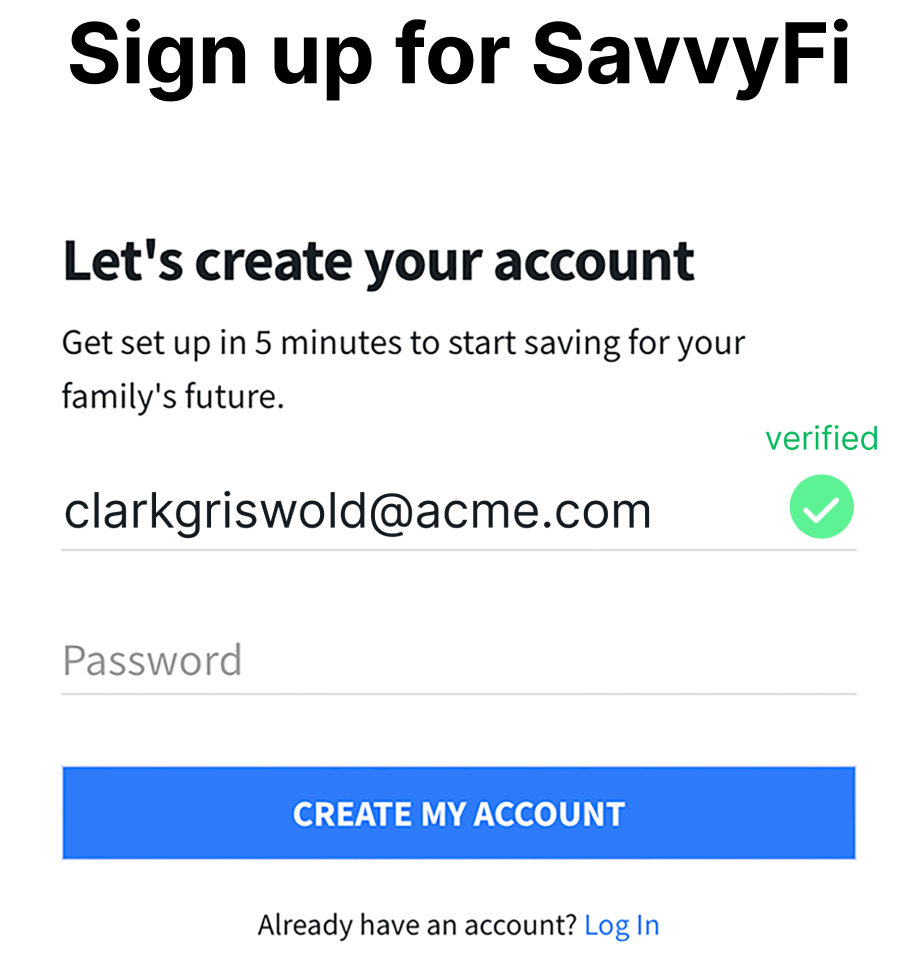

Employees enroll with their corporate email addresses on SavvyFi’s site

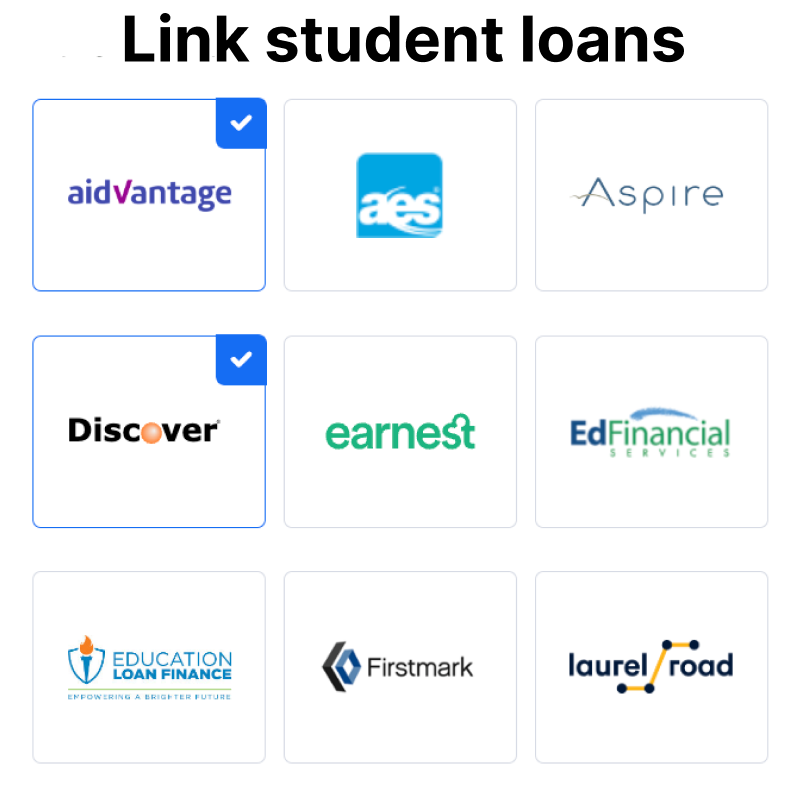

Employees complete enrollment by linking their loans with our widget

What Your Peers Are Saying

It’s clear. It’s intuitive. I like the fact that it’s not payroll deducted, and we’re not having to have changes made through payroll. And I just think it’s needed.

We implemented SavvyFi…Quite frankly, it is one of the easiest platforms. The interface, the gifting, the cashback rewards…its just really, really easy.

Happy Wednesday! Jeff, businesses need your service. 😀

Previous

Next

Discover the SavvyFi difference

Direct loan servicer integrations

Your tax-free employer contributions will go directly to the loan servicer, which will keep your program in compliance.

Flexibility to expand your program

SavvyFi brings 529 plans alongside student loan repayment to give your program room to grow.

127 out of the box

Save thousands in legal fees by keeping it simple with a template 127 document provided at no cost.

More ways to save

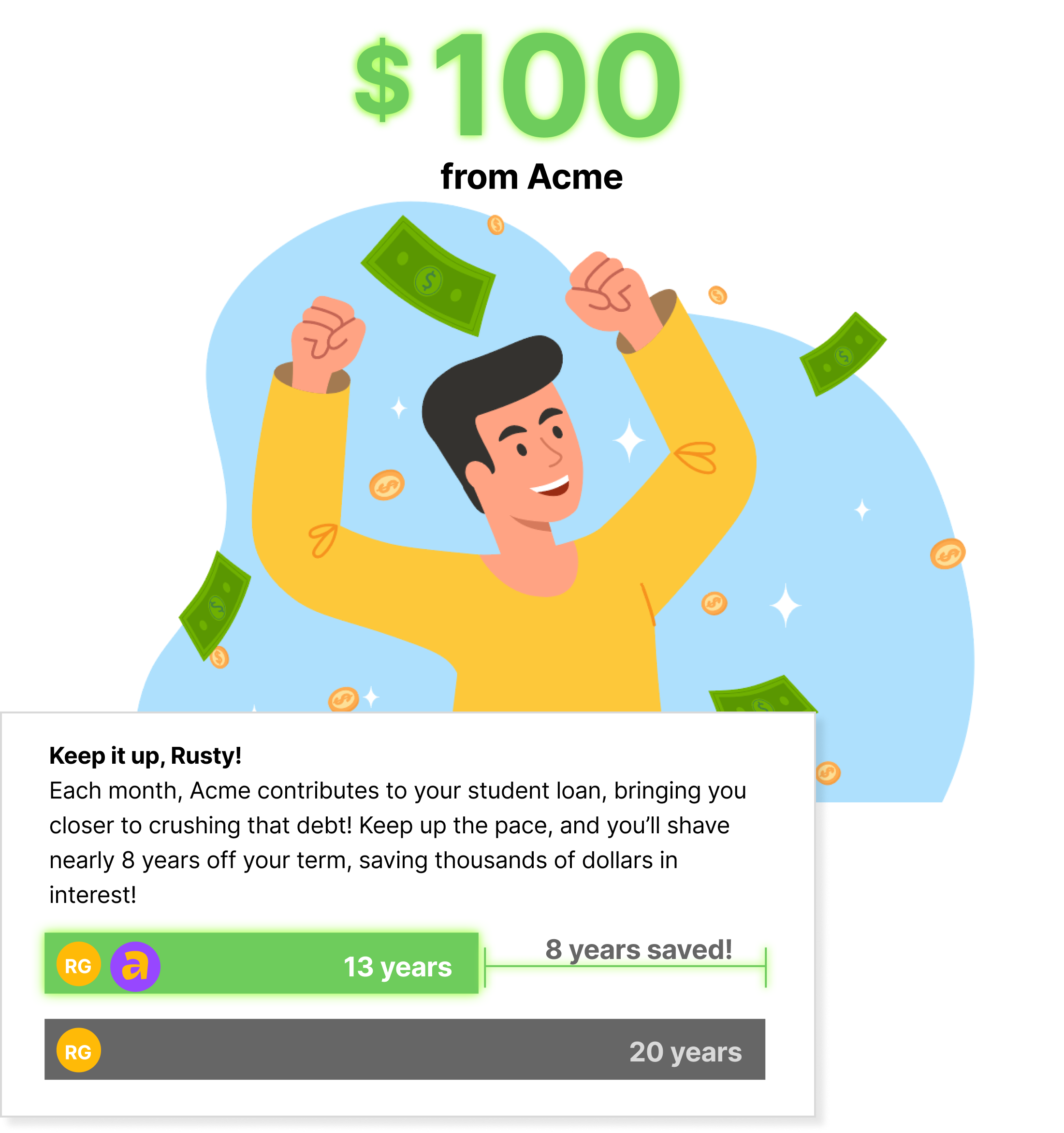

Employees can use SavvyFi’s gifting and cashback rewards to pay down their loans even quicker.

By the numbers...

of employees would commit to a company for five years if helped with their student loans.*

is a reasonable employee participation level you can use to estimate total cost of employer contributions.

monthly employer contribution is more than enough to set your benefit program apart from your competition.

SavvyFi fee per-enrolled-employee-per-month. No minimums, implementation fees, or fund transfer fees.

of employees would commit to a company for five years if helped with their student loans.*

is a reasonable employee participation level you can use to estimate total cost of employer contributions.

monthly employer contribution is more than enough to set your benefit program apart from your competition.

SavvyFi fee per-enrolled-employee-per-month. No minimums, implementation fees, or fund transfer fees.

Get the guide.

Not ready to book a meeting? Download our free guide to Implement Your Student Loan Repayment Benefit in 24 Hours.

Let’s have a chat!

Choose the best time and date, and we’ll send a calendar invite your way.

Frequently asked questions

What is SavvyFi?

SavvyFi is a digital web application that allows employees to save for a loved one’s education with a 529 plan and/or pay off current student loans. SavvyFi has direct integrations into a 529 plan and over 90% of student loan servicers, which allows employers to offer this new benefit in a frictionless and paperless way on any device.

How do employers implement SavvyFi?

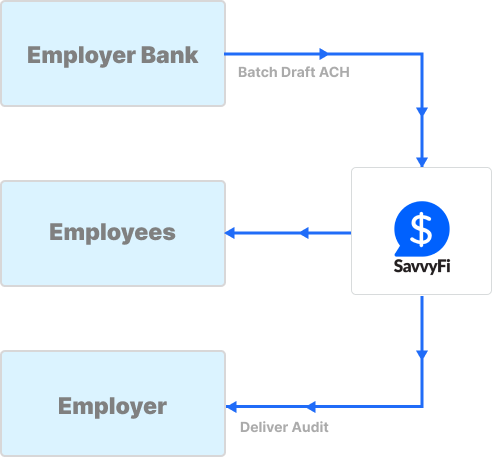

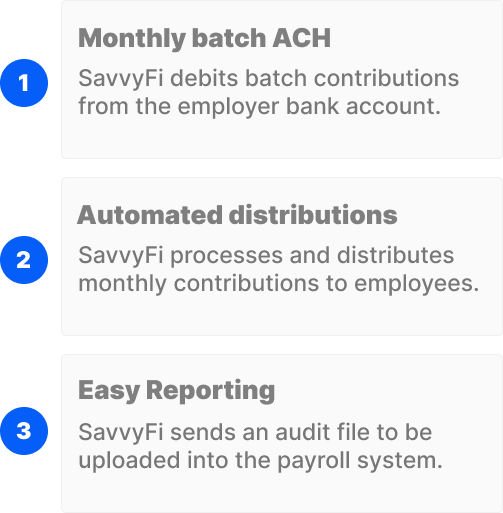

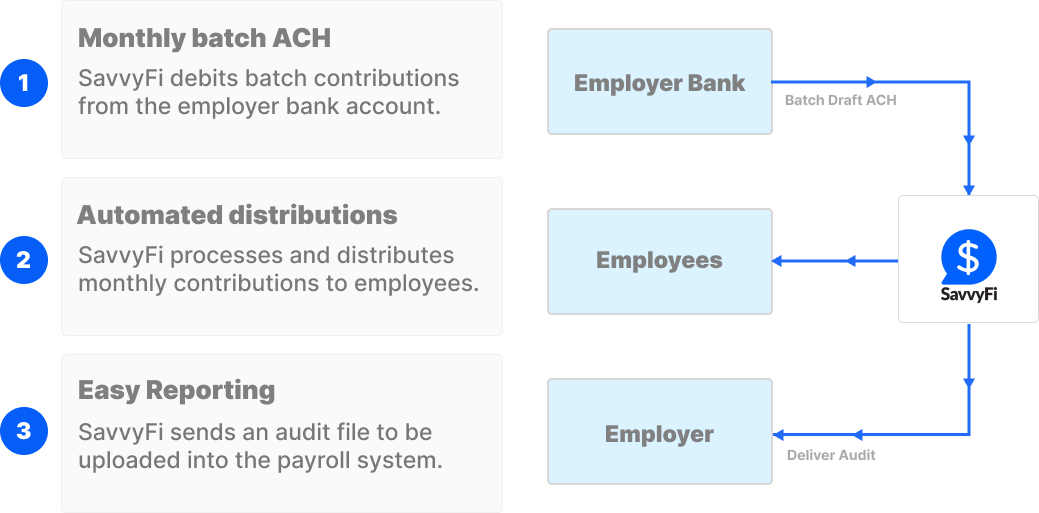

We send a contract for review and signature via email. Once the contract is digitally executed, your employees will instantly be able to sign up on SavvyFi's site with their work email address. To help you launch the benefit, you have access to a toolkit with handouts, presentations, and videos to share with your employees. If you are providing contributions, we set up a simple ACH debit which will automatically draft from your corporate account.

How much does SavvyFi cost?

$5 per enrolled employee per month. There are no minimums, implementation fees, or advisor fees.

How much administration is involved for employers?

Very little! SavvyFi provides enrollment materials for distribution, and there’s no payroll integration required. Individual enrollment is hands-off because employees will self-enroll through a simple link, and our advanced platform handles all money transmission, reporting, support requests and account changes.

Are employer contributions tax free?

If you have a written Section 127 plan in place, which we can provide, you can contribute up to $5,250 tax-free to an employee’s student loan each year

Does SavvyFi offer other benefits?

In addition to facilitating employer contributions to student loans, SavvyFi helps employees lower their monthly loan payments with a digital income-driven repayment program and allows employees to sign up for a 529 account to save for their own or a loved one’s future education.

How does SavvyFi’s cashback rewards feature work?

Employees who shop online, make purchases in-store, or book travel through SavvyFi’s cashback rewards program can earn up to 20% of their purchase in cashback to their student loans. The cashback program includes over 10,000 merchants. Major brands such as Target, Home Depot, and Walmart frequently have offers, as well as local merchants such as the neighborhood pizza shop.

How does the gifting feature work?

Employees are given a personalized link to share with others that allows them to easily receive gifts and messages from friends and family. Gifts are then applied directly to their loans.

Have Questions?

Request More Information.

Our expert team is on standby to answer any questions you may have about SavvyFi’s platform.

Savvy Financial, Inc. (“SavvyFi”) is a web-based investment adviser. Our investment advisory services are made available to U.S. residents only. This website shall not be considered a solicitation or offering for any service or product to any person in any jurisdiction where such solicitation or offer would be unlawful. Nothing in this website should be construed as investment, legal, tax, regulatory or accounting advice. Prospective investors should consult with their own legal, regulatory, tax, business, investment, financial and accounting advisers. While distributions to cover K–12 tuition are tax-free on the federal level, state tax treatment will vary, and you should check with your tax professional for details. All investments involve risk, including the possible loss of money you invest, and past performance does not guarantee future performance.