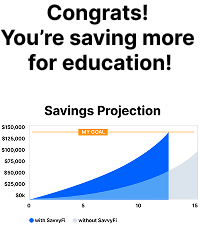

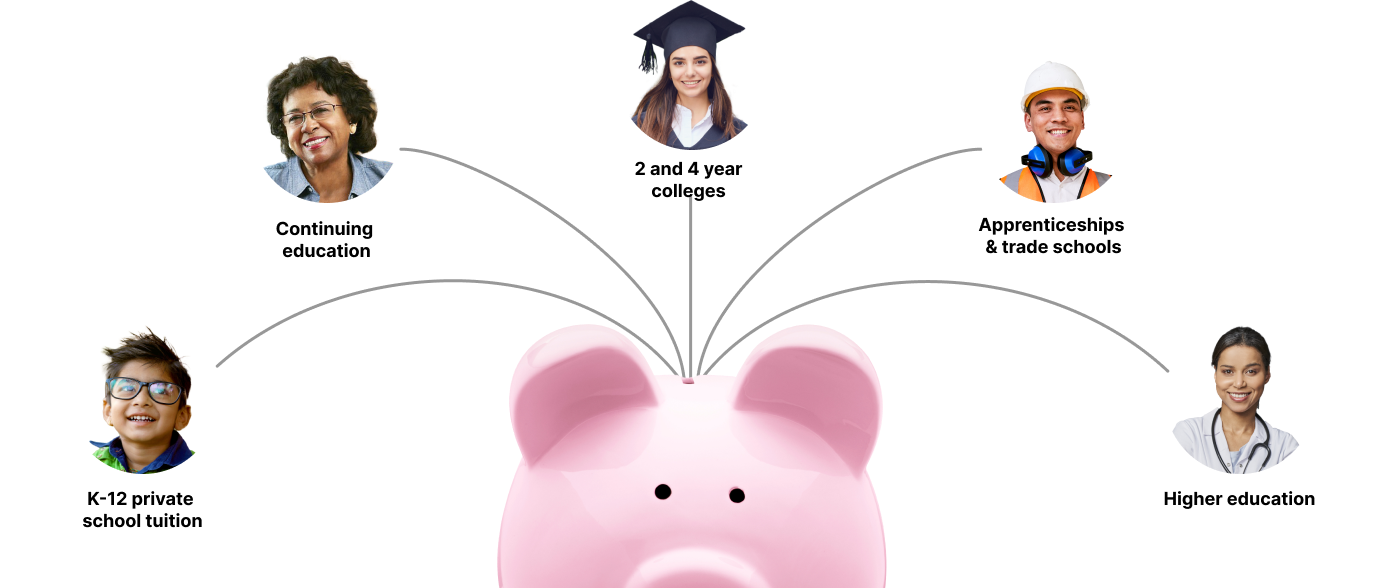

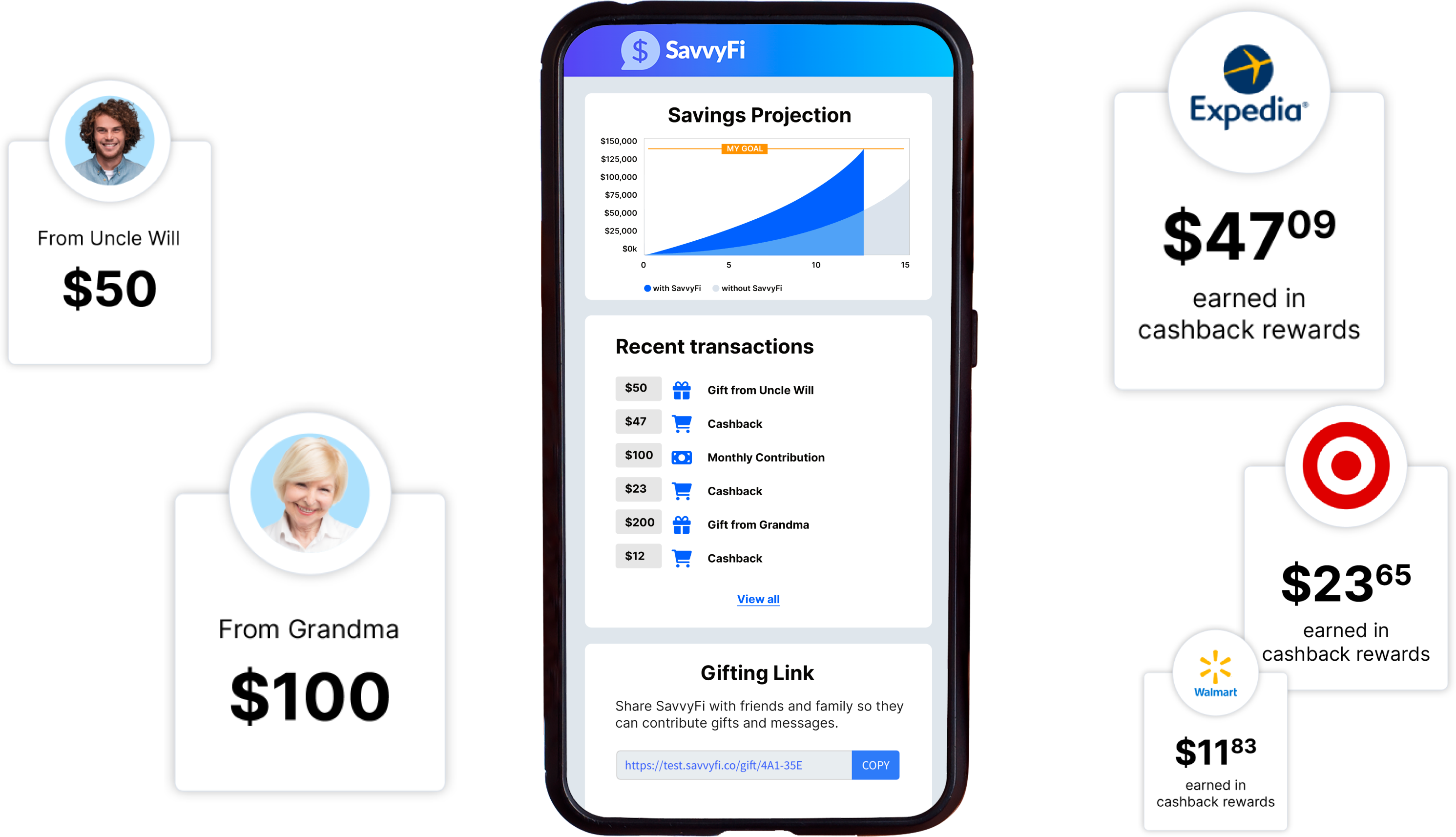

Save more for school with SavvyFi

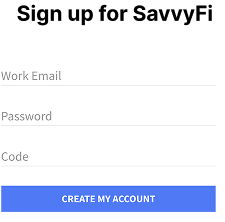

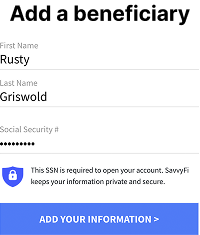

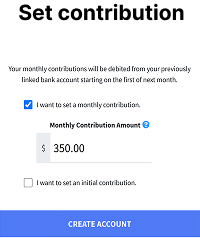

Voyant Beauty is proud to provide you with an exclusive offer to SavvyFi – an exciting new way to save for college. Open a 529 savings account and start contributing to education expenses for your future college star and Voyant Beauty will cover the monthly account fees.