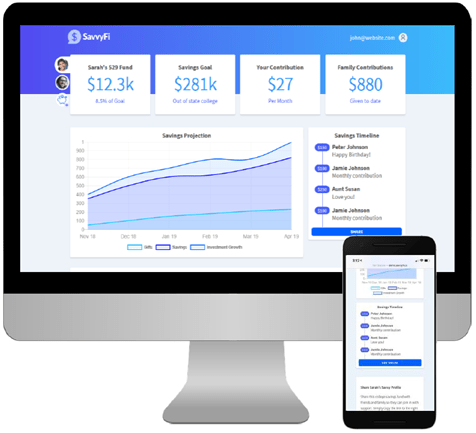

What Is SavvyFi?

A college education is often a big part of financial planning, but it can be difficult to figure out how best to save for it. We’ve created a simple financial platform that quickly sets up college saving accounts for anyone. With SavvyFi’s intuitive technology, you can easily enroll yourself, a child, or a loved one in a 529 savings plan.