Rural healthcare organizations serve as the backbone of America’s healthcare system, delivering essential care to millions in geographically isolated areas. However, these institutions face significant challenges, from workforce shortages and recruiting healthcare professionals to rural areas to financial constraints.

This post explores the core issues affecting rural healthcare and presents innovative solutions to overcome rural healthcare’s biggest workforce hurdles. Tactics explored include 1) repositioning your sign-on bonus so employees see your investment in them over the long term, 2) offering education financial benefits for your entire team at different levels, and 3) bolstering your messaging to candidates that spells out the financial impact of government incentive programs.

Workforce Challenges Unique to Rural Healthcare

1. Recruitment Crisis

Rural healthcare facilities often struggle to compete with urban hospitals offering higher salaries, better benefits, and more diverse professional opportunities. These disparities have created chronic staffing shortages, particularly for Family Nurse Practitioners (FNPs), Physician Assistants (PAs), and other key providers.

How difficult is it to recruit healthcare providers in rural settings?

“Healthcare is definitely challenging, especially on the recruiting side right now because everybody’s fighting for the same employees…. We’re having to come up with some very unique ways in which to recruit.” –Rural Urgent Care Clinic Operator

This is not a new problem: in 2017 the NIH studied “Recruiting Rural Healthcare Providers Today: a Systematic Review of Training Program Success and Determinants of Geographic Choices.” The article notes that “one fifth of the nation’s population resides outside metropolitan areas, only about a tenth of the nation’s physicians are found there.”

Compounding the issue, many healthcare workers are leaving roles after short tenures. In today’s competitive job market, professionals easily find opportunities elsewhere, leaving rural clinics with sudden vacancies that disrupt operations and compromise patient care.

2. Financial Constraints

Operating on razor-thin margins, rural clinics face difficulties in offering competitive salaries and benefits. Temporary closures due to staffing shortages can cause devastating financial losses.

“With 40 clinics, if we don’t have a provider, we have to close a clinic. And that just creates a lot of problems for the group as a whole. We’ll have Medical Assistants that aren’t getting paid. We have front desks that aren’t getting paid… it’s a domino effect.” – Rural Clinic Operator

While telemedicine offers a temporary fix, many rural patients prefer in-person care, further complicating revenue streams during closures.

3. Recruiting Healthcare Professionals to Rural Areas: High Turnover Rates

Burnout is a significant driver of high turnover in rural healthcare settings. Providers often face heavy workloads, limited support, and fewer professional development opportunities. During the COVID-19 pandemic, some clinics reported staff seeing over 100 patients daily, pushing them to their limits.

Without addressing these stressors, rural clinics risk losing staff to urban systems or entirely different industries.

4. Increased Competition for Talent

The healthcare job market is more competitive than ever. Urban systems and travel healthcare roles offer higher pay and better benefits, making it harder for rural clinics to attract providers. In many cases, providers can secure new positions within weeks, leaving rural organizations scrambling to fill gaps.

Innovative Solutions to Recruiting Healthcare Professionals to Rural Areas

While the challenges may seem daunting, healthcare organizations can adopt innovative solutions to recruit healthcare professionals to rural areas:

1. Strategy: Implement Financial Incentives

Structured student loan repayment plans, Secure 2.0 retirement matching, and lifestyle spending accounts can enhance the appeal of rural roles. Partnering with platforms like SavvyFi simplifies these benefit programs.

Tactic: Reposition Your Sign-on Bonus

This example comes from a healthcare system in Kentucky. They implemented an innovative strategy to support their Registered Nurses (RNs): offering sign-on bonuses specifically applied to student loans, with the bonuses vesting over four years. While the idea is excellent for recruitment and retention, they found the process extremely cumbersome for their team to manage manually.

Currently, their approach requires HR to request loan statements directly from employees, issue checks manually, and mail them to the loan servicers. As a small organization with limited staff, this process is labor-intensive and inefficient.

Through our platform, the RNs can easily log in, link their student loans, and automate the process.

Here’s how it works:

- After 30 days of employment, we transfer $5,000 from the employer’s account and deposit it directly with the loan provider.

- Each year, the employer funds another $5,000, and we handle the transfer seamlessly.

- This repeats until the initial bonus amount is reached.

This approach allows the healthcare system to maintain their retention-focused plan while significantly reducing the workload on their HR team.

Using sign-on bonuses tied to student loans not only supports recruitment but also naturally strengthens retention, leading us to our next strategy.

2. Strategy: Focus on Retention

Flexible schedules, increased support staff, and professional development opportunities are proven ways to reduce burnout and improve job satisfaction for healthcare providers. However, creative financial incentives can also boost retention and cut the costs of workforce gaps.

Tactic: Offer financial benefits focused on student debt relief for all employees, not just healthcare providers

Beyond repositioning sign-on bonuses for RNs and practitioners, consider extending financial benefits to all employees at your clinic or office. According to 2023 data from LinkedIn published in Becker’s Hospital Review, it takes an average of 59.5 days to hire a healthcare provider—and nearly 50 days to hire an HR professional. High turnover costs both time and money, making retention a critical priority across all roles.

Debt relief can be a game-changing benefit. The Education Data Initiative reports that while the average medical school debt is $200,000, undergraduate debt averages $25,670, and master’s degree debt averages $69,140. Imagine if employees knew that part of their monthly student loan payment was covered by the clinic, or if a portion of their annual performance bonus was allocated—tax-free—toward reducing their student debt.

Such a program would alleviate a significant financial burden for employees, improving their overall well-being and increasing their loyalty to your organization. By easing this stress, employees are more likely to stay, reducing the costs and disruption of recruiting and training new staff.

3. Strategy: Highlight the Mission and Government Incentives to Recruiting Healthcare Professionals to Rural Areas

Serving rural communities can be challenging but deeply rewarding. It’s essential to emphasize the positives when recruiting healthcare providers. Highlight the strong sense of community, the opportunity to make a meaningful impact during patients’ most trying moments, and the privilege of supporting multiple generations within families.

Additionally, the government offers programs that incentivize rural healthcare work. It’s important to communicate these benefits clearly to candidates. For example, Public Service Loan Forgiveness (PSLF) can significantly enhance the financial appeal of nonprofit healthcare roles.

Here’s a case study to illustrate this:

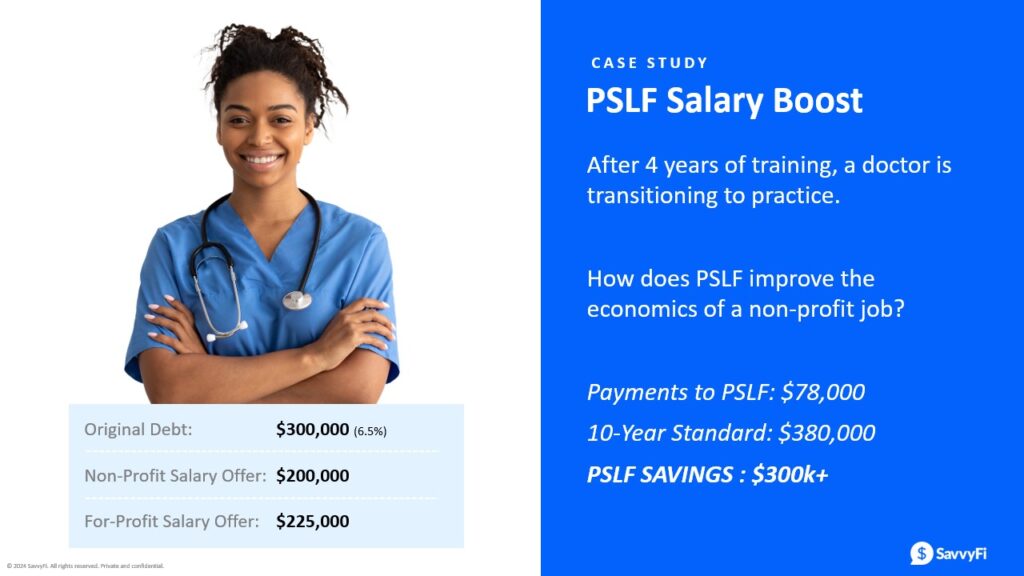

Case Study: PSLF vs. For-Profit Compensation

Consider a physician with $300,000 in student loan debt. If a nonprofit employer offers a $200,000 annual salary and a for-profit employer offers $225,000, the PSLF program could tip the scales in favor of the nonprofit offer.

PSLF Eligibility: To qualify for PSLF, candidates must work for a nonprofit organization and make 120 qualifying monthly payments under an income-driven repayment plan. These 10 years do not need to be consecutive but must be cumulative across eligible employers.

The Financial Breakdown: After completing four years of training while enrolled in an income-driven repayment plan, the physician transitions to a nonprofit role. Over the next six years, they would pay approximately $78,000 in total loan payments based on their salary. At the end of this period, the remaining balance—likely around $300,000—would be forgiven tax-free under PSLF.

By contrast, if the physician accepts the for-profit role, they must repay the entire $300,000 loan balance, which would cost approximately $380,000 out of pocket at current interest rates.

The Difference: Choosing the nonprofit role and pursuing PSLF saves the physician roughly $300,000 over the loan repayment period. This effectively adds substantial value to the nonprofit salary offer, making it highly competitive with or even superior to the for-profit alternative.

Tactic: Educate Candidates and Support Employees with Student Debt

- Break down the financial advantages of PSLF for candidates. Show how the program functions as a federal subsidy that significantly enhances compensation packages.

- Provide resources and guidance on navigating income-driven repayment plans, staying compliant with PSLF requirements, and understanding evolving legislation.

By clearly communicating these benefits and framing rural healthcare as both meaningful and financially advantageous, organizations can better attract top talent to serve their communities.

Ensuring the Future of Rural Healthcare

Rural healthcare organizations must rise to the challenge by investing in strategic solutions and fostering long-term change. By addressing workforce challenges and financial constraints, these institutions can position themselves as competitive and compassionate employers, ensuring quality healthcare for even the most remote regions of America.

Ready to Address Your Workforce Challenges?

Is your rural healthcare organization struggling with recruitment and retention? Let’s explore how tailored education finance benefits and strategic planning can make a difference.

About SavvyFi: SavvyFi is a user-friendly fintech platform that makes it easy for employers to provide college savings and student loan benefits to their employees. Because the company’s platform is “zero-touch” to HR — without any complicated systems, integrations, or paperwork — SavvyFi unlocks education financing capabilities to even the smallest employers that would not otherwise be able to offer these benefits.

Disclosure: Third-party quotes shown may not be representative of the experience of all SavvyFi customers and do not represent a guarantee of future performance or success.