Why It’s Essential

Average cost per year for college

$ 0 K+

Average amount of debt for each four-year college graduate

$ 0

Tax deductible amount for an employer to contribute to repay student debt

$ 0

SavvyFi helps your employees feel financially secure by saving up and paying down college student debt.

No payroll integration. No paperwork. No administrative burden to implement.

Your team can save for children, grandchildren, nieces, their own student loans and more.

Savings grow secure and tax-free in a top-tier 529 account. Plus, employer contributions to student debt are also tax free.

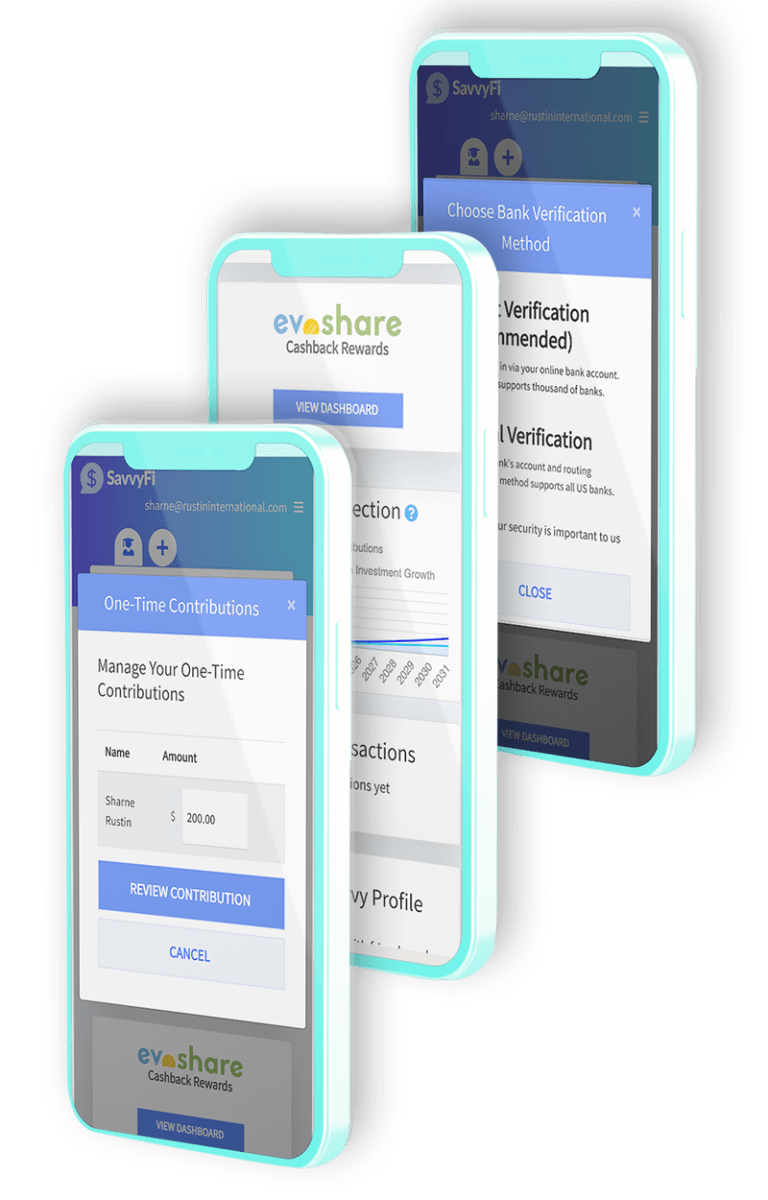

An intuitive dashboard that relieves anxiety about planning.

Both the 529 plan and student loan repayment can be funded by shopping at major and local merchants.

Provide matching contributions to attract and retain top talent.

Savvyfi is a digital investment adviser registered with the securities and exchange commission.

Our innovative technology makes it hassle-free and inexpensive for employers to offer college savings and student debt repayment benefits to their entire workforce.

A 529 plan is an investment account that allows savings to grow tax-free if the funds are used for qualified expenses at eligible higher education institutions. Eligible institutions include four-year universities, community colleges, trade schools, and private K-12 schools. Qualified expenses typically cover most costs associated with attending school. Learn more at: https://savvyfi.co/what-is-a-529/

Your employees can open an account for their children, grandchildren, nieces, nephews, and even the neighbor’s kid – as long as your employees have the future grad’s social security number.

Your employees with student debt can even open an account for themselves and use SavvyFi’s cashback rewards feature to pay down their debt more quickly.

We send a contract for review and signature via email. Once the contract is digitally executed, we enable our portal for your employees. This process typically takes under an hour.

To help you launch the benefit, you have access to a toolkit with handouts, presentations, and videos to share with your employees

If you are providing contributions, we set up a simple ACH debit based on your payroll report.

No. Even if you are making contributions, we clear the aggregated payments through one ACH deduction once a pay period and provide appropriate reporting and an audit trail.

The participation rate depends on many factors. Major factors include employer contributions and how the benefit is communicated to the employees. We have a toolbox to help you communicate clearly and efficiently to your employees about the benefit. For companies not providing contributions, the participation rate can range from 5-20%. For companies providing contributions, the participation rate can range from 10-40%.

We offer a full suite of online resources, including email templates, handouts, presentations, and videos. We also have a dedicated employee help line that can handle individual employee issues. We also offer a real-time webinar and the webinar recording can be reused for employees that can not attend.

Contact us for an estimated price based on the size of your organization and anticipated employee eligibility and adoption rates. There are no minimums, implementation, or advisor fees.

No!

If the child does not attend college, there are many options for how the savings can be used. They can transfer the 529 account to another family member, use the funds for their own education, or withdraw the funds to give their child a head start on other important financial goals. If the funds are not used for a qualified education expense, they can use all the deposits without penalty, but the earnings will be subject to a 10% penalty.

When an employee leaves your company, their student loans and 529 accounts continue to exist. Employees have the option to continue using the SavvyFi gifting and cashback features by assuming the monthly cost or discontinue using SavvyFi and access their loans and 529 accounts directly.

You can send us a list of approved employee email addresses and we can filter based on that list.

What is the error message for someone not on the list? [ps1]

No. As long as you differentiate by pay grade, position, or location, you can vary the amount of contributions. You are not allowed to discriminate across protected classes of people such as race, gender and age. However, we always recommend you seek legal advice before setting up different contribution levels between employees.

The tax-advantaged contribution for student loans has to be used for the employee. Per 26 U.S. Code § 127 - Educational assistance programs | U.S. Code | US Law | LII / Legal Information Institute (cornell.edu). However, contributions to 529 plans can be used to pay off any student loan.

No, employees access SavvyFi through a secure website, optimized for both mobile and desktop. SavvyFi performs just like a mobile app but does not require employees to download yet another app onto their phone.

Savvy Financial, Inc. (“SavvyFi”) is a web-based investment adviser. Our investment advisory services are made available to U.S. residents only. This website shall not be considered a solicitation or offering for any service or product to any person in any jurisdiction where such solicitation or offer would be unlawful. Nothing in this website should be construed as investment, legal, tax, regulatory or accounting advice. Prospective investors should consult with their own legal, regulatory, tax, business, investment, financial and accounting advisers. While distributions to cover K–12 tuition are tax-free on the federal level, state tax treatment will vary, and you should check with your tax professional for details. All investments involve risk, including the possible loss of money you invest, and past performance does not guarantee future performance.

Savvy Financial and the mark SAVVYFI are not associated with Heartland Financial USA, Inc. Savvy Financial will incorporate a legible and unobscured disclaimer on its website and any websites it owns that feature the SAVVYFI mark now or in the future.