Employer Toolbox

Download SavvyFi materials for your employees.

Looking for ways to communicate the amazing education financial benefits of SavvyFi? Look no further, as we’ve curated a variety of marketing materials for you below. You’ll find one-page flyers to distribute, videos that you can share, and content bites you can add to emails or presentations to help your employees better understand the power of SavvyFi.

Videos

We’ve created the videos below for you to give your employees a high-level introduction to SavvyFi. They include an overview of the SavvyFi employee benefit, our Demo Invite video, the basics of 529 plans, and how SavvyFi’s cash back feature works.

SavvyFi Videos

Employee Messaging Kit

Below are some content bites you can use in your communication with employees.

What Is A 529 plan?

A 529 plan is a tax advantaged way for employees to save for future college expenses or pay off existing student loan debt. As long as the money saved is used for qualified educational expenses like tuition, the gains made on investments by your employees 529 plan are tax free. In addition, SavvyFi’s cash back rewards and gifting features make it easier for employees to save.

This overview page explains more about what a 529 plan is: https://savvyfi.co/what-is-a-529/.

Highlight Gifting

Highlight Cashback

SavvyFi is a unique benefit that helps you save for future college expenses or pay off existing student loan debt with a 529 plan. The cash back rewards make it easier for you to save. By registering your credit card, you can earn up to 30% of their purchases at participating merchants including Home Depot, Target, and Walmart as well as local retailers. All the rewards will automatically be deposited into your 529 plan account.

This overview video explains how to use the cashback feature: https://youtu.be/47f20LCLwT0

Intro Email Snippet

As a reminder, we have adopted a new benefit for all employees to help you save for a loved one’s college or pay down student debt.

You can save for a child, student loans, grandchild, friend, and/or other family member with SavvyFi, a new provider that we’ve partnered with that allows you to easily set up a 529 plan to fund you or your family’s higher education needs. SavvyFi’s employee benefit is available at no cost to employees.

SavvyFi not only allows you to contribute your own funds to your 529 account, it also has a simple gifting feature so friends and family can contribute, and a tie-in with a cashback rewards program that contributes when you buy products or services from participating companies. In fact, if you’re like a typical SavvyFi member, you could save almost $1,200 extra each year using the friends and family gifting and cashback rewards features!

TO OPEN YOUR ACCOUNT, FOLLOW THESE INSTRUCTIONS:

- Go to Enroll – SavvyFi, and click any of the “Sign Up for My Benefit” buttons.

- Sign up using your company email address.

- Look for the green checkmark to know you are using an approved email address:

- Fill out basic information about you and who you are saving for, and your 529 account will automatically be opened.

If you have questions about 529s, take a look at SavvyFi’s 529 page, email them at [email protected], or set up a one-on-one.

We are looking forward to helping you start saving today!

Prebuilt Marketing Materials

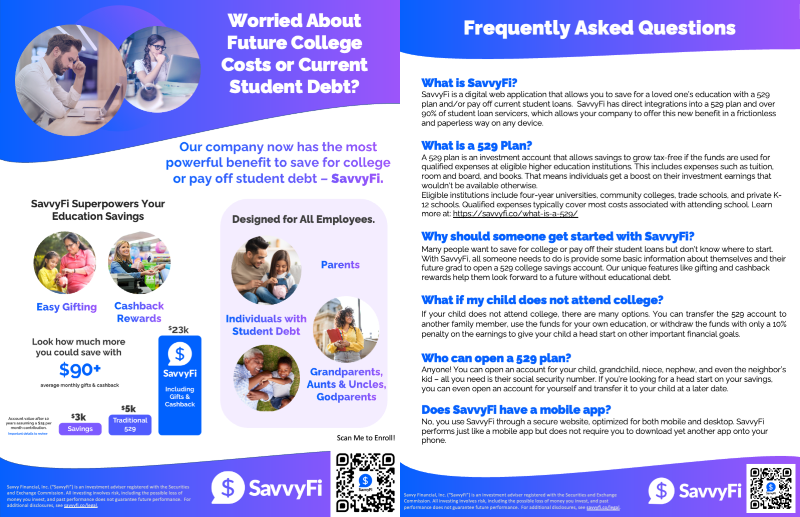

Employee Enroll Flyer

Download our Employee Enroll flyer for a convenient way to educate employees via email or physical hand-out.

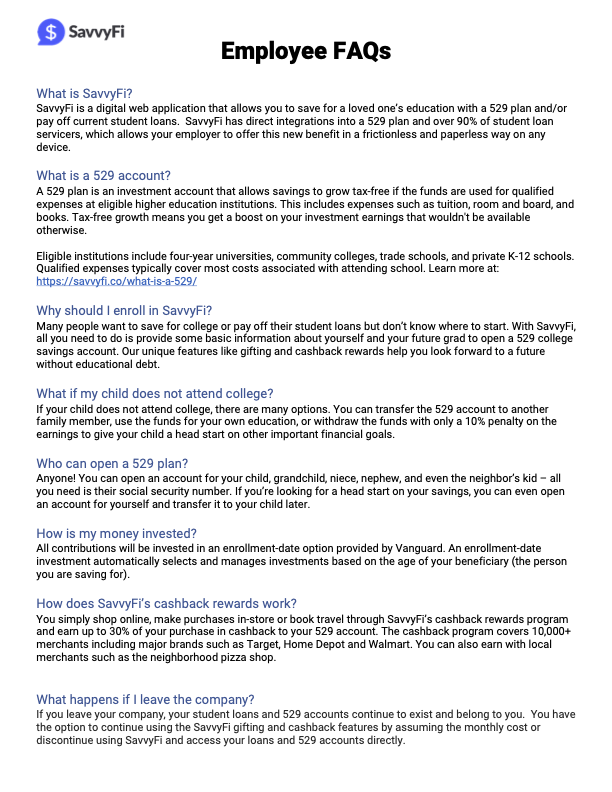

Employee FAQs Handout

Download our Employee FAQ a handout or as text for your own collateral.

Not A SavvyFi Client Yet?

Employee Frequently Asked Questions

SavvyFi is a digital web application that allows you to save for a loved one’s education with a 529 plan and/or pay off current student loans. SavvyFi has direct integrations into a 529 plan and over 90% of student loan servicers, which allows your employer to offer this new benefit in a frictionless and paperless way on any device.

Many people want to save for college or pay off their student loans but don’t know where to start. With SavvyFi, all you need to do is provide some basic information about yourself and your future grad to open a 529 college savings account. Our unique features like gifting and cashback rewards help you look forward to a future without educational debt.

A 529 plan is an investment account that allows savings to grow tax-free if the funds are used for qualified expenses at eligible higher education institutions. This includes expenses such as tuition, room and board, and books. Tax-free growth means you get a boost on your investment earnings that wouldn't be available otherwise.

Eligible institutions include four-year universities, community colleges, trade schools, and private K-12 schools. Qualified expenses typically cover most costs associated with attending school. Learn more at: https://savvyfi.co/what-is-a-529/

Anyone! You can open an account for your child, grandchild, niece, nephew, and even the neighbor’s kid – as long as you have their social security number. If you’re looking for a head start on your savings, you can even open an account for yourself and transfer it to your child at a later date.

You simply shop online, make purchases in-store or book travel through SavvyFi’s cashback rewards program and earn up to 30% of your purchase in cashback to your 529 account.

The SavvyFi cashback program covers 10,000+ merchants including major brands such as Target, Home Depot and Walmart. You can also earn with local merchants such as the neighborhood pizza shop.

All contributions will be invested in an enrollment-date option provided by Vanguard. An enrollment-date investment automatically selects and manages investments based on the age of your beneficiary (the person you are saving for).

If your child does not attend college, there are many options. You can transfer the 529 account to another family member, use the funds for your own education, or withdraw the funds with only a 10% penalty on the earnings to give your child a head start on other important financial goals.

If you leave your company, your student loans and 529 accounts continue to exist and belong to you. You have the option to continue using the SavvyFi gifting and cashback features by assuming the monthly cost or discontinue using SavvyFi and access your loans and 529 accounts directly.